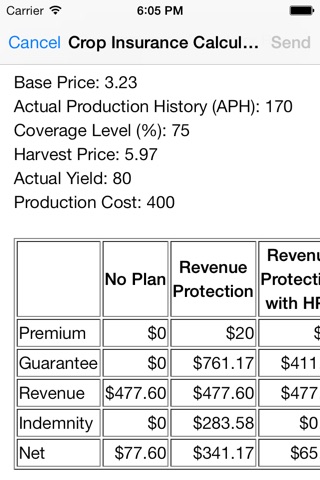

Simulate crop insurance scenarios for two common types of crop insurance: Revenue Protection and Revenue Protection with Harvest Price Exclusion.

Scenario results can be emailed.

RP = Revenue Protection Policy

RP-HPE = Revenue Protection with Harvest Price Exclusion

All fields are per acre.

APH = Actual Production History

Actual Yield = Estimated Yield (change this value to see the difference in indemnity payments)

Production Cost = Cost of production per acre. This is used to determine the Net per acre.

Premium = cost per acre of a policy.

Guarantee = Guaranteed revenue amount per acre based on the actual production history, coverage percentage, and the basis price (or harvest price).

Revenue = Actual Yield x Harvest Price. If Revenue is less than the Guarantee, then an Indemnity is paid based on the difference.

Indemnity = payment.

Net = Revenue + Indemnity - Production Cost - Premium

This application is intended as a tool for exploring various insurance options. It does not promote or advertise any insurance policies and is not affiliated with any insurance providers or the US Government.

Additional explanation of policy types from the US Risk Management Agency (RMA):

Revenue Protection policies insure producers against yield losses due to natural causes such as drought, excessive moisture, hail, wind, frost, insects, and disease, and revenue losses caused by a change in the harvest price from the projected price. The producer selects the amount of average yield he or she wishes to insure; from 50-75 percent (in some areas to 85 percent). The projected price and the harvest price are 100 percent of the amounts determined in accordance with the Commodity Exchange Price Provisions and are based on daily settlement prices for certain futures contracts. The amount of insurance protection is based on the greater of the projected price or the harvest price. If the harvested plus any appraised production multiplied by the harvest price is less than the amount of insurance protection, the producer is paid an indemnity based on the difference.

Revenue Protection With Harvest Price Exclusion policies insure producers in the same manner as Revenue Protection polices, except the amount of insurance protection is based on the projected price only (the amount of insurance protection is not increased if the harvest price is greater than the projected price). If the harvested plus any appraised production multiplied by harvest price is less than the amount of insurance protection, the producer is paid an indemnity based on the difference.